OUR SERVICES

Kuldhara’s loans to women organised under Joint Liability Groups help them build their lives and come out of the vicious circle of poverty. In integrating these underserved segments of the society with financial and banking services, Kuldhara wishes that every individual dreams and achieves them.

MID-TERM LOAN

Extending financial assistance to current Joint Liability Group (JLG) customers who are in the process of repaying their loans, with a primary repayment amount ranging between 40% and 70%.

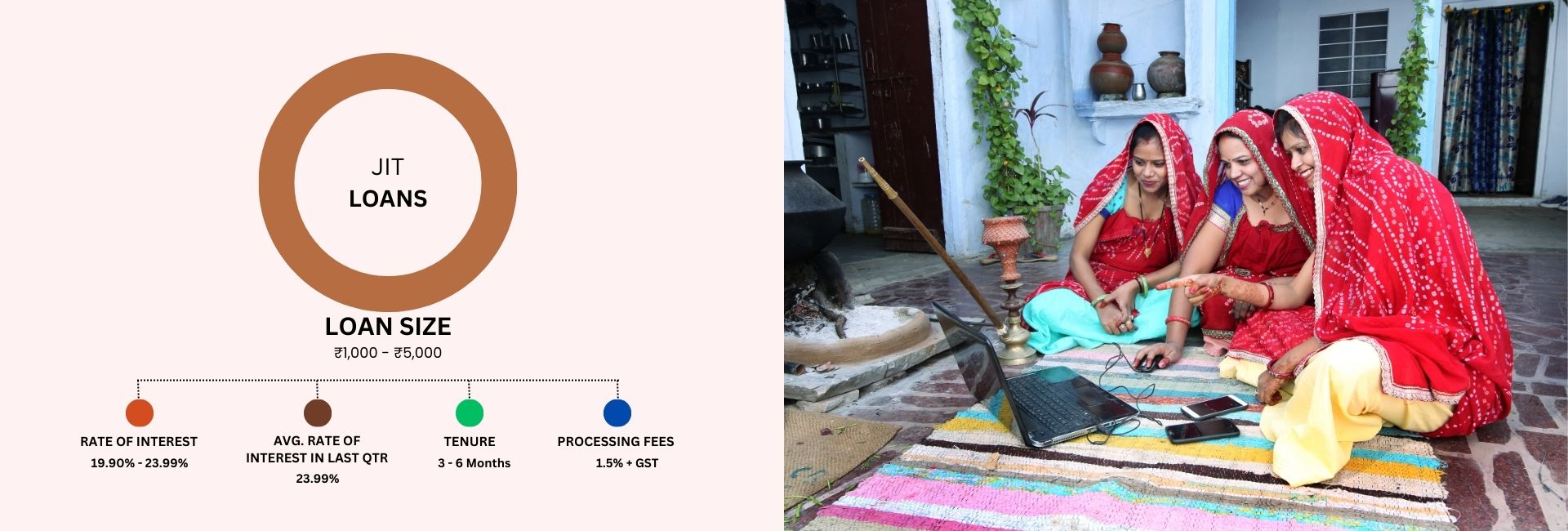

JIT Loan

The Just In Time loan is a pre-approved emergency loan product designed to provide quick financial assistance to existing customers. This short-term loan serves various purposes, including covering medical bills, educational expenses, debt consolidation, repairs, renovations & micro business needs among others.

Group Loans

Providing loans to rural households, especially women, to expand their existing businesses or venture into new livelihood activities, thereby diversifying their income sources. These loans could be utilized in agricultural endeavours, establishing and nurturing microbusinesses, supporting handicraft and handloom industries, among others.

MSME Business Loan

We extend our support to micro, small, and medium enterprises, addressing their crucial working capital requirements. Our product is strategically crafted to offer seamless financing solutions to both registered and unregistered business segments. These loans are classified into two categories, secured and unsecured, determined by the client’s profile, often influencing the loan amount. The loan supports upgrading existing business infrastructure, restocking inventory, and expanding operational capacities, among other business-enhancing endeavours.

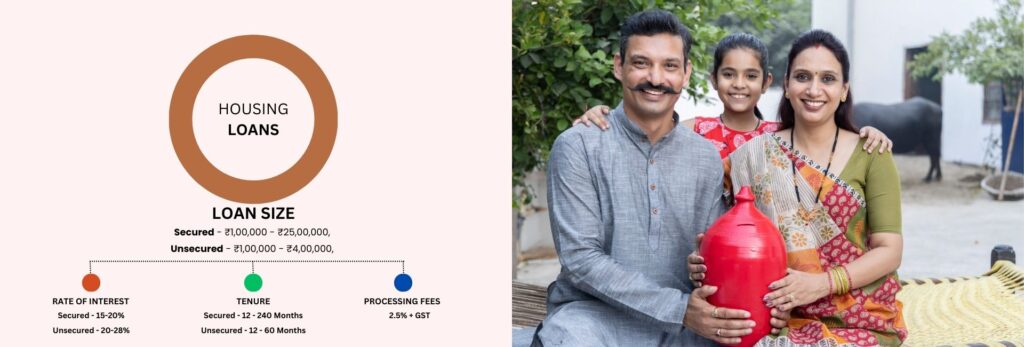

Housing Loan

Empowering households with a sense of social security and economic well-being, we cater to the growing demand for affordable home loans. Our secured & unsecured lending solutions offer higher ticket size loans to individuals with both formal and informal sources of income, covering various needs such as home construction, flat purchase, home renovation, and balance transfers.

Samarth Loan

Financial assistance to marginalized segments who have historically been excluded from mainstream financial services. This inclusive program specifically targets individuals such as persons with disabilities, transgender people, single mothers, widows, unmarried women, and leprosy-affected communities.

Safe Water and Sanitation to Households (SWASTH)

Our SWASTH Loan is designed to facilitate the installation of safe water and sanitation infrastructure. Our loan product is structured to deliver a wide range of advantages, including increased convenience, time savings, improved privacy, enhanced safety, decreased healthcare costs, and an overall enhancement in the quality of life.

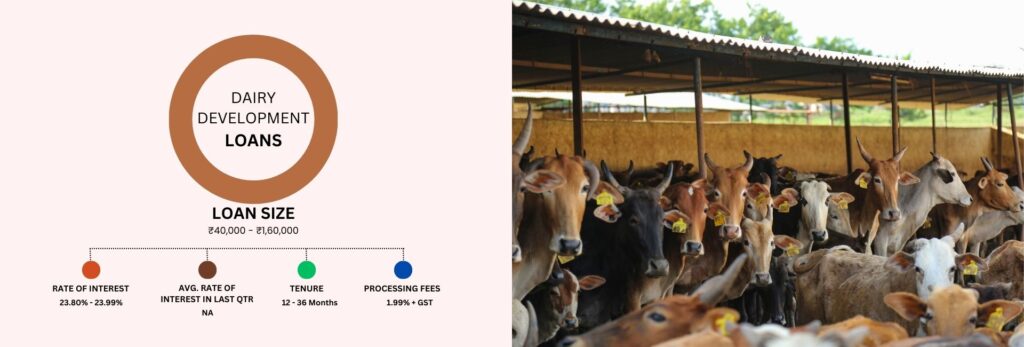

Dairy Development Loan

Our Dairy loan aims to provide comprehensive financial assistance for various aspects of dairy farming. This includes financing for cattle purchases, infrastructure development, medical support, and other additional expenditures.

RTS Loan

Financial assistance for the installation of solar panels, catering to both residential and commercial needs. We aim to facilitate the transition towards renewable energy sources, supporting individuals and businesses in harnessing the power of solar technology for a greener tomorrow.

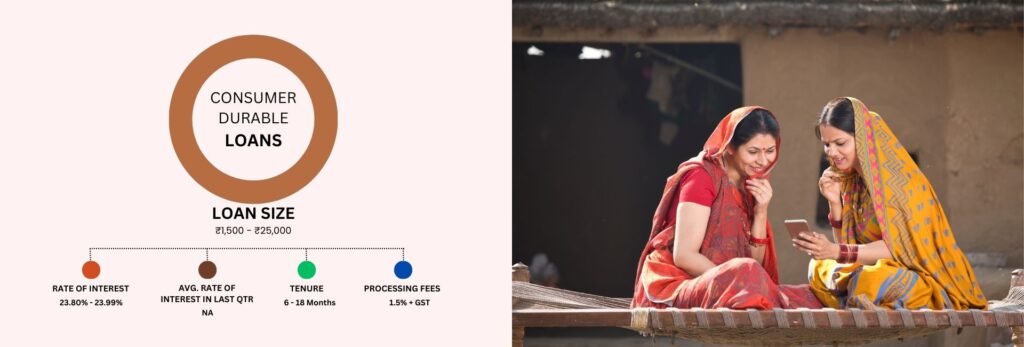

Consumer Durable Loans

The loan targets our existing customers seeking financial support for the acquisition of consumer durable goods & home appliances. Its purpose is to fulfil their financial requirements and facilitate an enhanced quality of life.

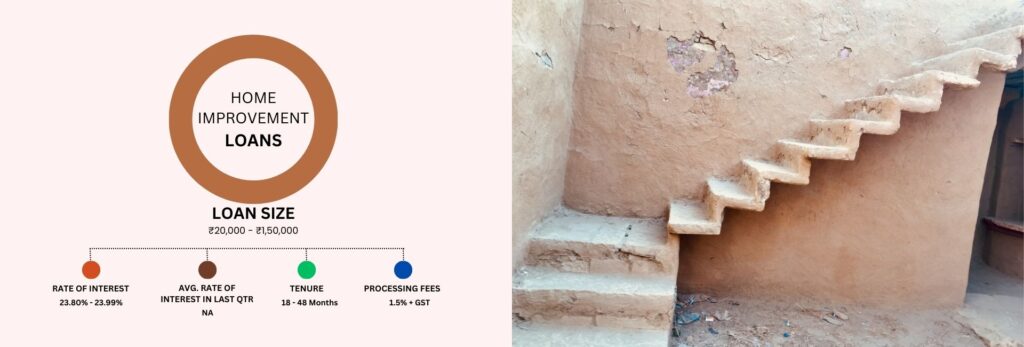

Home Improvement Loan

Our Home Improvement loan empowers customers to enhance their existing homes, thereby elevating their quality of life and ensuring their privacy, safety, and well-being. By availing this loan, individuals and families can upgrade their living conditions, creating a positive impact on their lives.

PMSVANidhi Loan

Providing essential working capital assistance to street vendors who are actively engaged in vending their goods and services in both urban and rural areas.

Loans are provided for the following activities:

Agriculture

- Vegetable Farming

- Fruits

- Cash Crops

- Vermiculture

- Agro Equipment

- Nursery

- Irrigation

Livestock and Animal Husbandry

- Goat rearing

- Sheep rearing

- Cow and Buffalo rearing

- Poultry

- Fisheries

- Donkey

- Piggery

Tertiary Activities

- Grocery Shop

- Fast food stalls

- Fruits and Vegetable shops and stalls

- Pickle Making

- Food Processing

- Fruit Processing

- Beauty Parlour

- Electrical Repair Shop

- Tyre Puncture Shop

- Two Wheeler Repair Shop

Handmade Work

- Brick Making

- Agarbatti Making

- Spice Making

- Garment Stitching

- Blanket and Durrie Weaving

- Textile Weaving

- Candle Making

- Furniture Making

- Pottery

Family Needs

- Hospitalization

- Marriage

- Education

- House Construction and Repairing

- Shop Construction and Repairing

- Land buying and Leasing

- Vehicle for commercial use

- Sanitation facilities construction

- Education and further studies

Loan Features

Group Size – 5-20 women

Group Features – 100% women

- Those with very small businesses

- Those who wish to start their own businesses

- They need not be literate

Loan amount (per person) - Ranging from INR 25000-80000

Rate of Interest – 26%

Tenure – 18-28 months

Processing Fee – 1%

Installment Repayment – Every 28 days

Late Payment Charge – NA

Documents Requirement – Valid KYC documents

Navigation

Menu

Important Links

Menu

Contact Us

E-55, 1st Floor, Girdhar Marg Sector 12, Malviya Nagar, Jaipur, Rajasthan 302017, Bharat

0141-2988234

info@kuldharainvestment.com