Sonu Rajawat

What We Do

At Kuldhara Investments, we provide loans to women organized under Joint Liability Groups which help them build their lives and come out of the vicious circle of poverty. In unification to the disproportionate segments of the society with financial and banking services, Kuldhara lends to these women, while keeping in mind their needs and requirements for their overall upliftment towards themselves and the society at large and empowering them for better and brighter future, their families and the society and come out of the poverty circle. Kuldhara Investments wishes that every woman dreams and achieve them with the right path and financial support provided to them. At Kuldhara Investments, we strive to build a better and brighter future for the society.

FINANCIAL UPLIFTMENT

ENGINE OF GROWTH

ENABLING SKILL DEVELOPMENT AND ENTREPRENEURSHIP

Kuldhara promotes economic prosperity for poor households by providing micro loans to women entrepreneurs

Through micro credit, Kuldhara enables its women stakeholders to strive for and reach to their entrepreneurial dreams

As an integral part of rural, small scale and unbanked sector, Kuldhara addresses diverse financial needs of the nation

How We Do It

Kuldhara follows a rigorous methodology while supporting women to stand on their own feet

Formation

Formation of Joint liability group

Training

Two days of compulsory group training

KYC

One day of group recognition test

Counselling

Credit counselling

Disbursement

Loan Disbursement

Loan repayment

Loan repayment

Ethics

Loan utilization check

What Drives Us

Company Profile

Business Philosophy

Spreading across all vectors within the domain of work focusing granularly by providing best-in class service to our customers, embracing change and financial & technological innovation with upgradation for required growth.

Goals

To serve 1 million customers proficiently and invest in capability building of team

Need to understand delivery or disbursement mechanism of financial services, leverage latest technologies in all processes and practices

To safeguard ecological balance and bring accuracy and efficiency; adopt paperless, cashless eco-friendly means & options to offer consistent services at competitive rate and involve customers to practice preventive tools to minimize the financial risks and emergencies

To ensure financial sustainability of all stakeholders, regularly review products, processes, protocols, policies and plans

To ensure global business standards, educate and ensure all stakeholders adhere requisite compliances and code of conduct

Vital Statistics

At the heart of our mission lies the commitment to empower communities through financial inclusion. Our growing presence and strong numbers are a testament to the lives we’ve touched and the trust we’ve built.

1.5 Lakhs+ Lives Impacted

Transforming futures through accessible financial services.

₹240 Crore Portfolio

A robust and growing loan portfolio, fueling dreams and businesses.

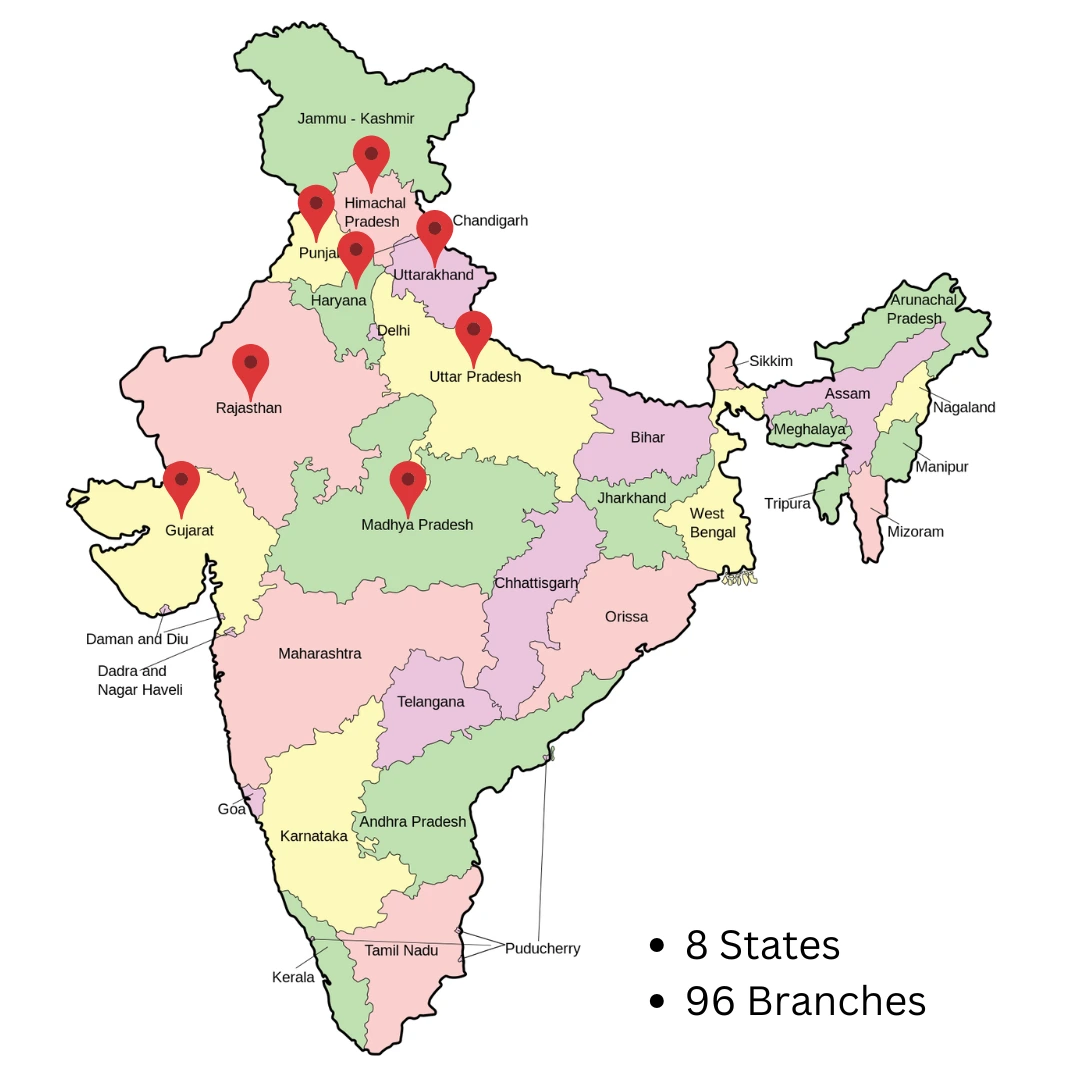

8 States

A wide footprint across India, reaching diverse communities.

96 Branches

Deeply rooted in local ecosystems to serve better and faster.

588 Employees

A dedicated team driving change at the grassroots.

Our Banking Partners

Our Business Partners

Impact Story of

Vijay Lakshmi Pradhan

Seema Badguzar

Grocery Shop

The foundation of her shop – Kuldhara!

32 years old

Sonu’s mother-in-law was a member of Kuldhara’s JLG and ran a tea shop in the locality. It wasn’t difficult to convince her of microfinance’s benefits. With three loans in the past 4 years, she has not only populated her grocery store, but she has also bought another house along with her hard-working auto rickshaw driver husband. She intends to sell artificial jewelry also from her shop with the next loan from Kuldhara.

Garment Retail and Stitching

Poster Woman of Success

32 years old

The poster woman of success at Kuldhara, Vijay Lakshmi has a post-graduation in commerce and a B Ed degree. Smart and intelligent, she is called as a representative at Kuldhara office when agencies come for routine or surprise checks, Founders Day and Women’s Day. With a supportive mother-in-law and husband, she has availed of the benefits of microfinance for the past 5-6 years with Kuldhara. Leader of her group - Saroj Naya Khada Group – she encourages other women nearby to use Kuldhara’s services and benefits and asks them to stand on their own feet and do their bit for increasing their household income. She says, “We must keep ourselves engaged in some activity. If not, we will go mad doing nothing in the house.” She does fall, pecco on sarees for various big saree selling shops around, stiches blouses and kurtis, and earns about INR 5000-8000 per month. She bought her first sewing machine with the first loan she availed from Kuldhara, and today with her expectant fifth loan, she intends to start a boutique in her area – the first one in her locality.

Gota artisan

A dream of a house

30 years old

Seema’s husband had taught her how to embroider gota lace on dresses, sarees and dupattas. When he left for Jodhpur for better work opportunities, Seema felt very alone and depressed. He advised her to begin working. When she began to work and found financial assistance through Kuldhara, they could immediately construct a new house for themselves. A consolidated amount from Kuldhara gave an immediate push to their house dream and they can now repay the loan in easy instalments!

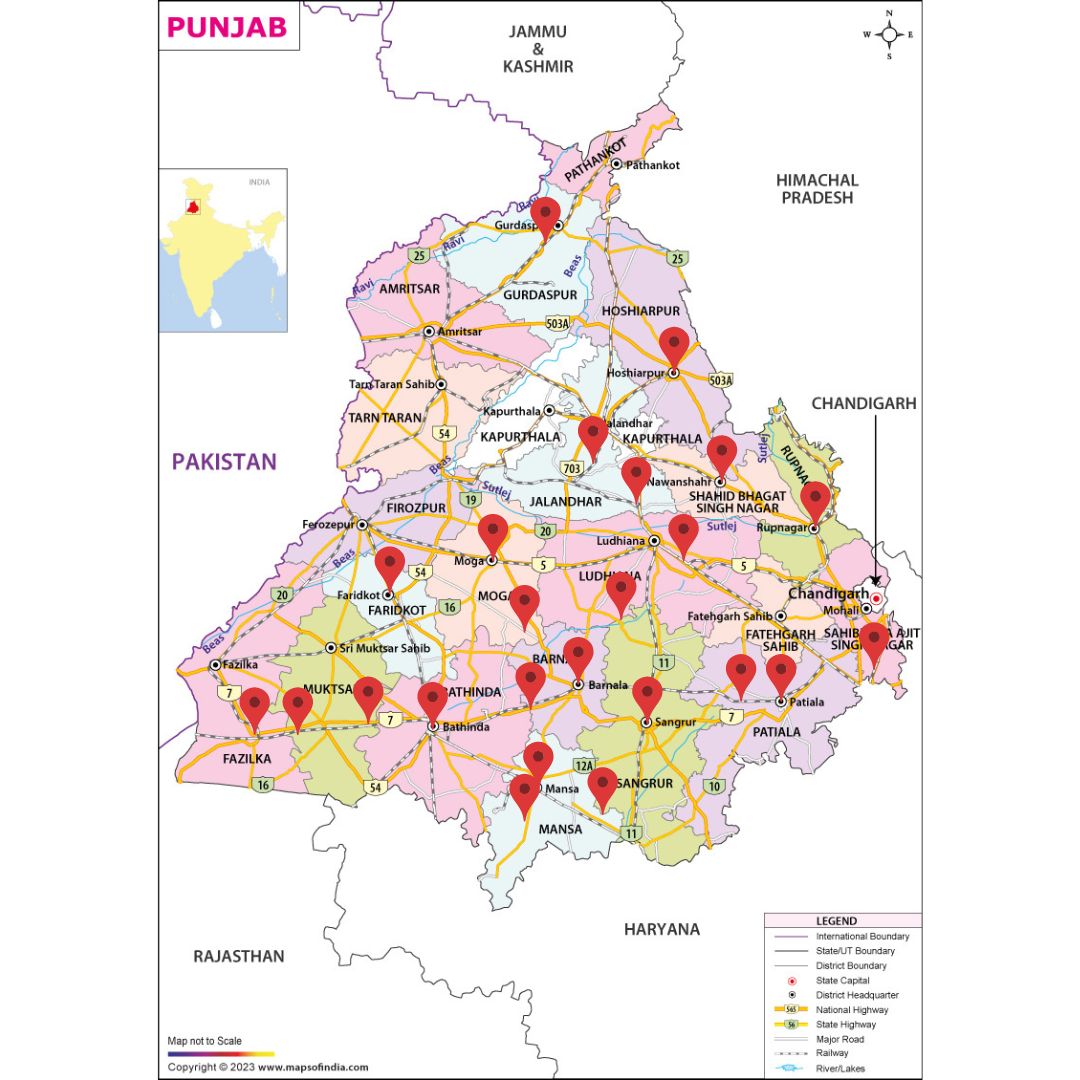

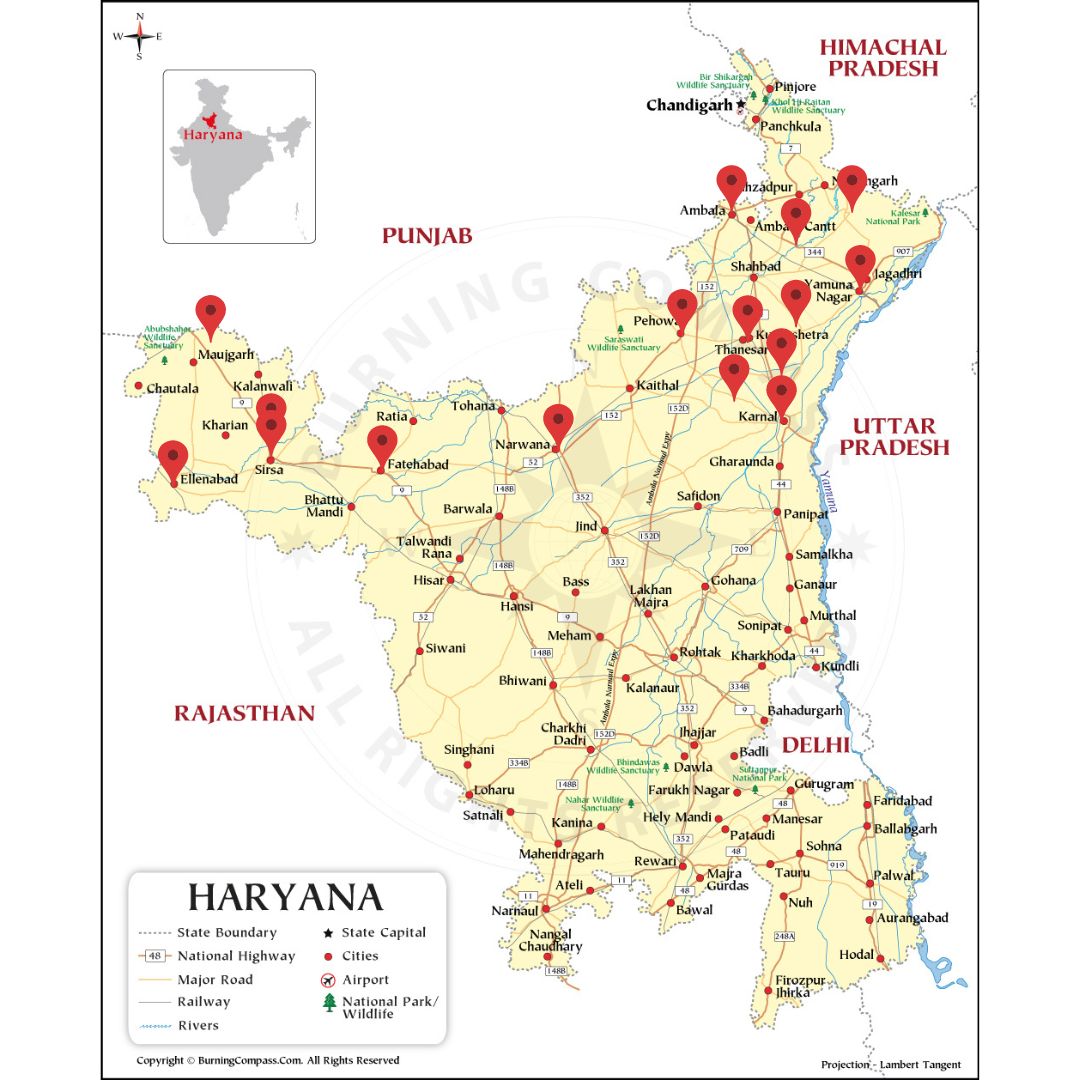

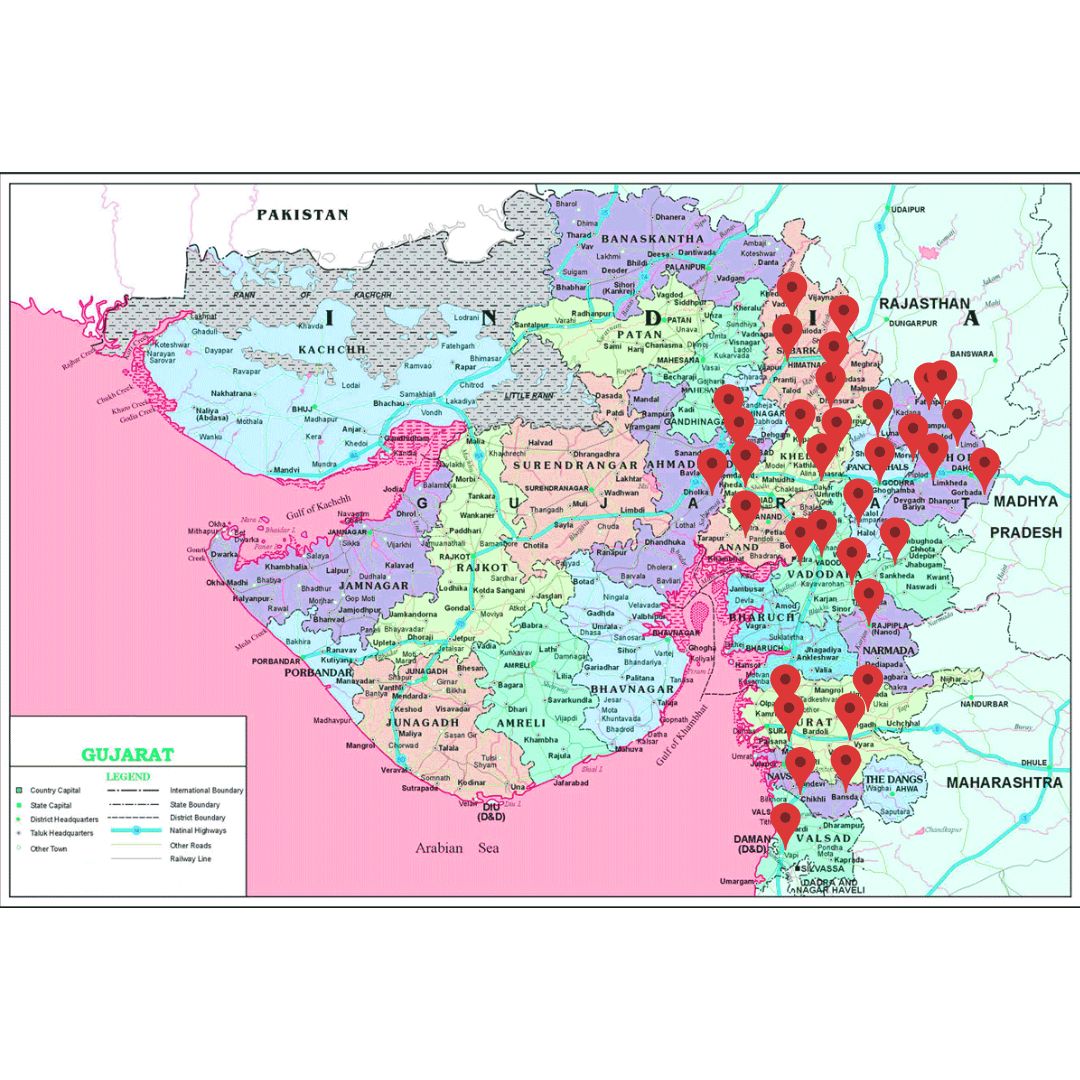

Our Presence

Kuldhara Investments has its presence across 8 states with 96 branches

Rajasthan

Himachal Pradesh

Uttarakhand

Madhya Pradesh

Punjab

Haryana

Gujrat

Navigation

Important Links

Contact Us

E-55, 1st Floor, Girdhar Marg Sector 12, Malviya Nagar, Jaipur, Rajasthan – 302017

0141-4523746

info@kuldharainvestment.com