MICROFINANCE

Microfinance mainly refers to micro-credit, specifically small loan, which is granted to low income group people. There is no shortage of initiatives in developing countries, but there is a lack of funding for starting a business.

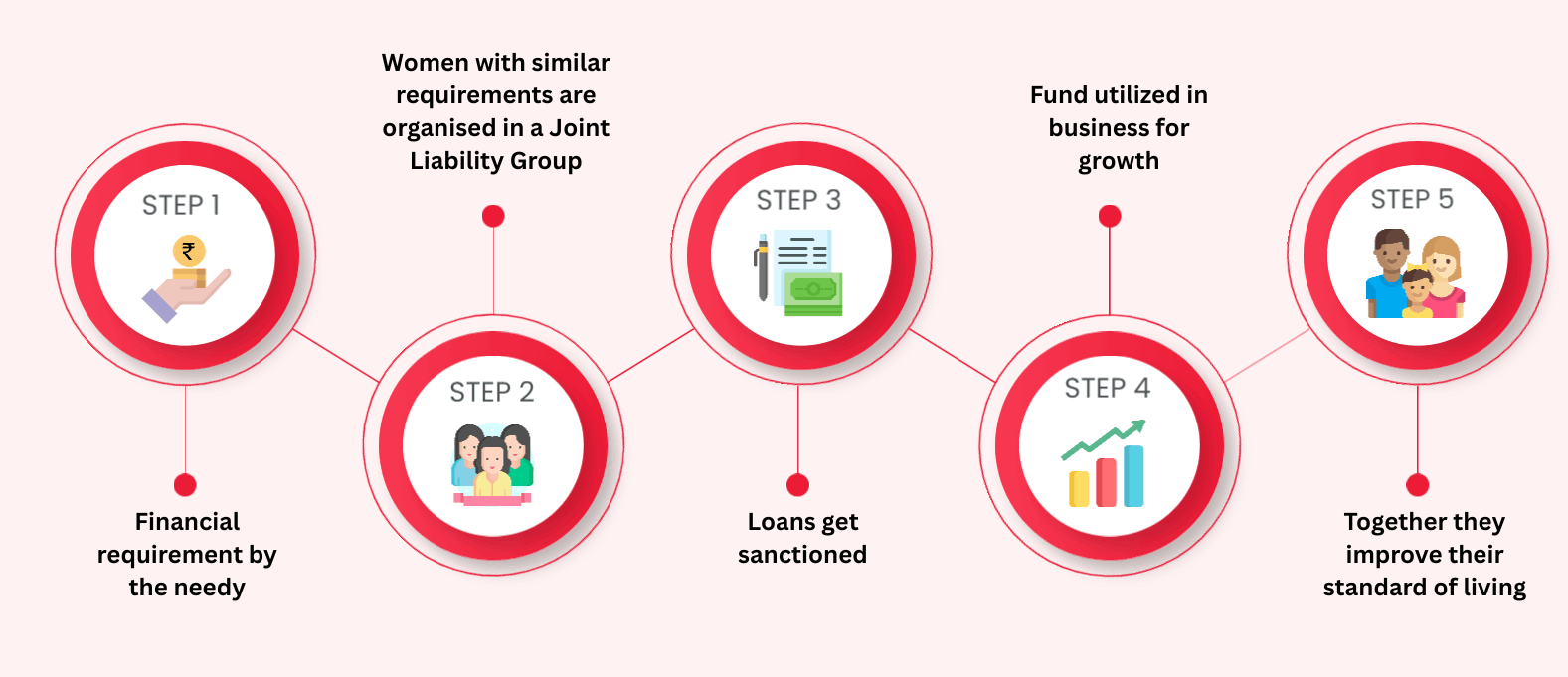

Growth path

Microfinance, initiated by Muhammad Yunus in 1976, has proved to be a very crucial step in the upliftment of low-income rural and urban people across the world, and is still successfully implemented and is currently prevalent in the financial sector. The key highlights of microfinance are:

- Microfinance is an innovative form of lending that empowers the section of people who are poor, yet contribute to half of the world population, that make up half of world population

- Microfinance empowers women as they take better financial decisions , save and invest money and allocate resources wisely

- Lending to women benefits the entire household. Since women have no other access to credit, they remain loyal to the group and repay their loans on time

- Since the loan amounts are small and lent for shorter durations, people find it easy to borrow and repay the loans, while making their business and economic statuses grow

- Since the application process is very easy, microfinance is popular among all products in the financial sector

- Group formation and peer pressure keeps an emotional connect within and a check on all the members

- They tend to save more as their financial capability increases.

- Lower interest rates are another important reason for its popularity

- Microfinance leads to creation of many enterprises, even if its an OPC (One Person Company). But they instil an entrepreneurial and professional spirit and ethics among the family members, especially children

- As households prosper, aspirations fly higher and members work harder towards achieving a better life

With the increasing use of microfinance, consciousness has been raised in the sectors of health and education among the women. Apart from poverty alleviation, microfinance enhances skill development, entrepreneurship and self-sufficiency. It also proves that the poor are not a burden on any economy, but they can contribute to it in a very constructive way.

Navigation

Menu

Important Links

Menu

Contact Us

E-55, 1st Floor, Girdhar Marg Sector 12, Malviya Nagar, Jaipur, Rajasthan – 302017

0141-4523746

info@kuldharainvestment.com